JURIS

JURIS is a solution for managing non-performing and disputed loans, equipped with an open architecture that allows seamless integration into any ecosystem (Banking Information System, ERP, etc.).

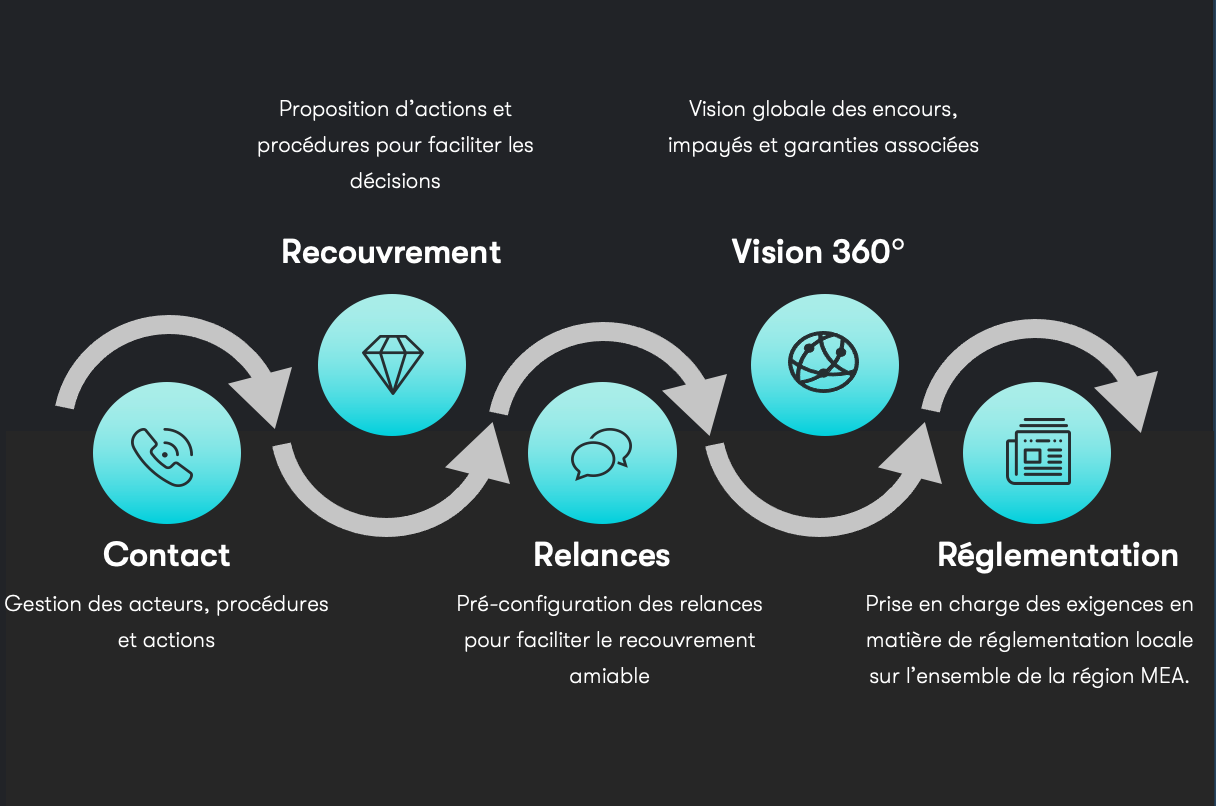

From loan management to contentious debt recovery

JURIS is a comprehensive solution that incorporates a complete and agile configuration, enabling compliance with all regulations related to reclassification, risk management, provisioning, and debt recovery.

It has been designed to adapt to the banking sector and microfinance activities

Automation

Automated processing of reclassification, provisioning, and recovery workflows for efficient case management.

360° Vision

Comprehensive data on NPL and disputed-loan clients (KYC, claims, guarantees, assets, third parties, history, etc.) to support decision-making and facilitate amicable recovery

Communication

Communication tools enabling effective interactions with clients as well as third parties involved in case handling

Adapted to your regulatory requirements and seamlessly integrates into your technological ecosystem.

Configurable

A flexible solution to handle all required business rules.

Localization

Native support for regulatory requirements and banking best practices

Cloud Native

Cloud-based solution delivered in SaaS mode, natively integrated with market-leading Core Banking systems.

Performant

High scalability while ensuring a strong level of security.

Processes and Data

Data processing, workflows that simplify case management, and dashboards

Fully Digital

A cutting-edge, fully digital solution enabling fast and secure deployment.

End-to-End Value Proposition

A complete solution in terms of functionalities, addressing your challenges in managing NPL and disputed loan cases while ensuring full compliance with regulatory requirements.

It will be a true asset in the recovery of outstanding debts.”